UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☑

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-

6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under Sec. 240.14a-12

READING INTERNATIONAL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☑ No fee required

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

(1) Title of each class of securities to which transaction applies: __________

(2) Aggregate number of securities to which transaction applies: __________

(3) Per unit price or other underlying value of transaction computed pursuant to

(4) Proposed maximum aggregate value of transaction: __________

(5) Total fee paid: __________

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2)

(1) Amount Previously Paid: __________

(2) Form, Schedule or Registration Statement No.: __________

(3) Filing Party: __________

(4) Date Filed: __________

TABLE OF CONTENTS

ABOUT THE ANNUAL MEETING AND VOTING.....................................................................................................................2

CORPORATE GOVERNANCE.............................................................................................................................................7

Director Leadership Structure...........................................................................................................................................7

Management Succession.................................................................................................................................................8

Board’s Role in Risk Oversight...........................................................................................................................................9

“Controlled Company” Status...........................................................................................................................................9

Board Committees.........................................................................................................................................................9

Consideration and Selection of the Board’s Director Nominees.............................................................................................10

Code of Ethics.............................................................................................................................................................11

Review, Approval or Ratification of Transactions with Related Persons...................................................................................11

Material Legal Proceedings...........................................................................................................................................12

READING INTERNATIONAL, INC.

6100 Center Drive,5995 Sepulveda Boulevard, Suite 900300

Los Angeles,Culver City, California 9004590230

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON Thursday, June 2, 2016wednesday, NOVEMBER 7, 2018

TO THE STOCKHOLDERS:

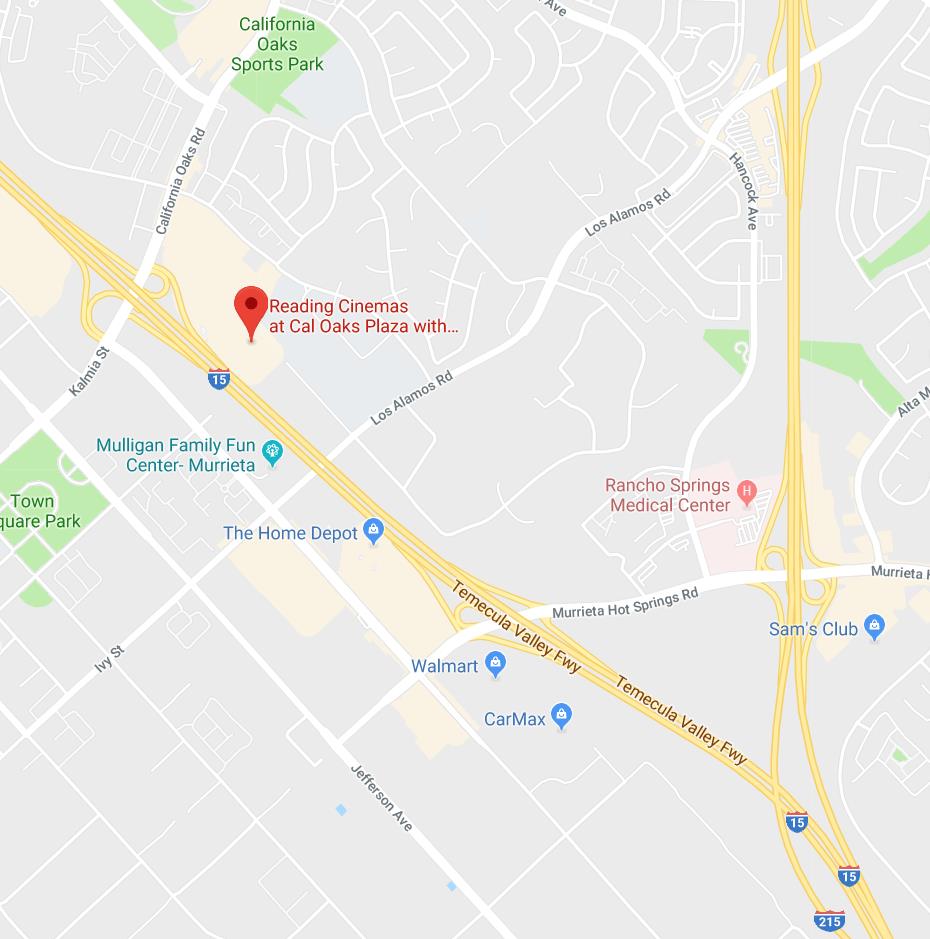

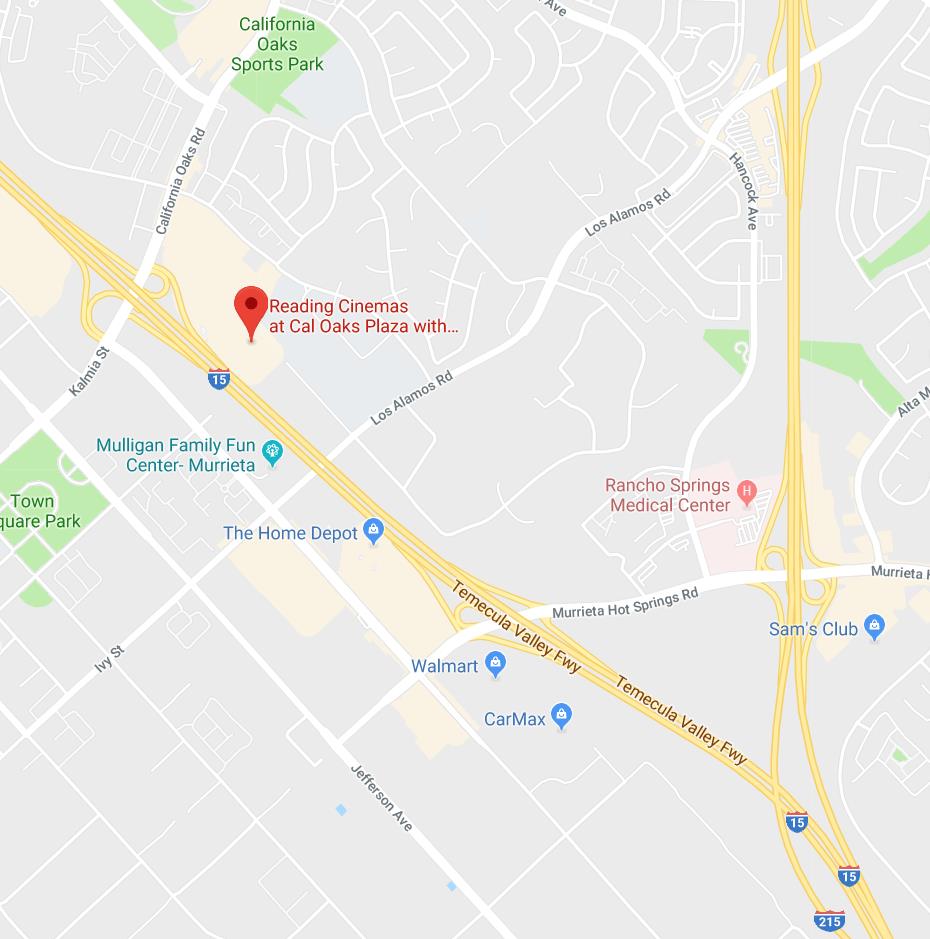

The 20162018 Annual Meeting of Stockholders (the “Annual Meeting”) of Reading International, Inc., a Nevada corporation, will be held at Courtyard by Marriott Los Angeles Westside,our Reading Cinema located at 6333 Bristol Parkway, Culver City,the California 90230,Oaks Plaza, 41090 California Oaks Road, Murrieta, California 92562, on Thursday, June 2, 2016,Wednesday, November 7, 2018, at 11:00 a.m., Local Time,local time, for the following purposes:purposes:

| 1. | | To elect seven Directors to serve until the Company’s 2019 Annual Meeting of Stockholders or until their successors are duly elected and qualified; |

| 2. | | To ratify the appointment by the Company’s Audit and Conflicts Committee of Grant Thornton as the Company’s independent auditor for the year ended December 31, 2018; |

| 3. | | To approve, on a non-binding, advisory basis, the executive compensation of our named executive officers; and |

| 4. | | To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

1.To elect nine DirectorsIt is my pleasure to serve untilcordially invite all of our stockholders to attend the Company’s 2017 Annual Meeting of Stockholders and thereafter until their successors are duly elected and qualified; andmeeting in person. A map is provided on the following page to assist you in locating our Reading Cinemas, which is at the California Oaks Plaza in Murrieta.

2.To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

A copyCopies of our Annual Report on Form 10-K and Form 10-K/A for the fiscal year ended December 31, 2015 is2017 are enclosed (the(together, the “Annual Report”). Only holders of record of our Class B Voting Common Stock at the close of business on April 22, 2016,Monday, September 17, 2018, are entitled to notice of and to vote at the Annual Meeting andor any adjournment or postponement thereof.

Whether or not you plan on attending the Annual Meeting, we ask that you take the time to vote by following the Internet or telephone voting instructions provided on the enclosed proxy card or by completing and mailing the enclosed proxy card as promptly as possible. We have enclosed a self-addressed, postage-paid envelope for your convenience. If you later decide to attend the Annual Meeting, you may vote your shares even if you have already submitted a proxy card.

By Order of the Board of Directors,

Ellen M. Cotter

Chair of the Board

This Proxy Statement, form of proxy and Annual Report are first being sent or given to stockholders on or about October 8, 2018.

May

Important Information for Stockholders Attending

Reading International, Inc.’s 2018 Annual Meeting

| |

Meeting Date: | Wednesday, November 7, 2018 |

Meeting Time | 11:00 A.M. Local Time |

Meeting Venue: | Reading Cinemas California Oaks Plaza 41090 California Oaks Road Murrieta, California 92562 www.readingcinemasus.com/caloaks |

Directions:

From Los Angeles International Airport (approx. 80-90 minutes):

Take the I-105 E/Norwalk from S. Sepulveda Blvd. (4 min). Use the right 2 lanes to take exit 18 for the I-605 S. Use the right 3 lanes to take exits 7A to merge onto CA-91 E. Use the right 3 lanes to take exit 51 to merge onto I-15 S towards San Diego. Use the second from the right lane to take exit 65 for California Oaks Road. Exit left on Kalmia St and continue onto California Oaks Road (1 hour and 19 2016minutes). Turn right on Monroe Ave and a second right on Symphony Park Lane into the plaza driveway (4 min). Continue onto driveway and make a quick left, then a quick right towards Reading Cinemas. The cinema will be on the left side.

From San Diego International Airport (approx. 60-80 minutes):

Take the I-5 S to the CA-163 N towards Escondido (8 minutes). Continue on the CA-163 N and merge onto the I-15 N. Exit California Oaks Road (Exit 65) using the right two lanes to turn right (57 minutes). Then turn right at the second cross street onto Monroe Ave. Turn right on to Symphony Park Lane into the plaza driveway (3 minutes). Continue onto driveway and make a quick left, then a quick right towards Reading Cinemas. The cinema will be on the left side.

From Ontario International Airport (approx. 45-60 minutes):

Take the I-10 E to exit 58B and merge onto I-15 S/Ontario Fwy towards San Diego/Corona. (3 minutes) Exit California Oaks Road (Exit 65) using the left 2 lanes to turn left onto Kalmia St. (41 minutes). Continue onto California Oaks Rd and turn right onto Monroe Ave. Turn right onto Symphony Park Lane (4 minutes) and make a quick left, then a quick right towards Reading Cinemas. The cinema will be on the left side.

Source: Google Maps

October 8, 2018

READING INTERNATIONAL, INC.

6100 Center Drive,5995 Sepulveda Boulevard, Suite 900300

Los Angeles,Culver City, California 9004590230

PROXY STATEMENT

Annual Meeting of Stockholders

Thursday, June 2, 2016Wednesday, November 7, 2018

INTRODUCTION

This Proxy Statementproxy statement (the “Proxy Statement”) is furnished in connection with the solicitation by the Board of Directors of Reading International, Inc. (the “Company,” “Reading,” “we,” “us,” or “our”) of proxies for use at our 20162018 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Thursday, June 2, 2016,Wednesday, November 7, 2018, at 11:00 a.m., local time, at Courtyard by Marriott Los Angeles Westside,our Reading Cinemas located at 6333 Bristol Parkway, Culver City,the California 90230, andOaks Plaza, 41090 California Oaks Road, Murrieta, California 92562, or at any adjournment or postponement thereof. This Proxy Statement and form of proxy are first being sent or given to stockholders on or about May 19, 2016.

At our Annual Meeting, you will be asked to (1) elect nine Directors to our Board of Directors (the “Board”) to serve until the 2017 Annual Meeting of Stockholders, and (2) act on any other business that may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting.

As of April 22, 2016,September 17, 2018, the record date for the Annual Meeting (the “Record Date”), there were 1,680,590 shares of our Class B Voting Common Stock (“Class B Stock”) outstanding.

When proxies are properly executed and received, the shares represented thereby will be voted at the Annual Meeting in accordance with the directions noted thereon. If no direction is indicated,

Important Notice Regarding the shares willAvailability of Proxy Materials for the Annual Meeting to be voted: FOR each of the nine nominees named in thisheld on November 7, 2018.

Our Proxy Statement for election to the Board under Proposal 1.and Annual Report are both available free of charge at https://investor.readingrdi.com/.

ABOUT THE ANNUAL MEETING AND VOTING

Why am I receiving these proxy materials?

This Proxy Statement is being sent to all of our stockholders of record as of the close of business on April 22, 2016,day September 17, 2018, by Reading’sour Board of Directors (our “Board”) to solicit the proxy of holders of our Class B Stock to be voted at Reading’s 2016our 2018 Annual Meeting, which will be held on Thursday, June 2, 2016,Wednesday, November 7, 2018, at 11:00 a.m. local time, at Courtyard by Marriott Los Angeles Westside,our Reading Cinema located at 6333 Bristol Parkway, Culver City,the California 90230.Oaks Plaza, 41090 California Oaks Road, Murrieta, California, 92562.

What items of business will be voted on at the Annual Meeting?

There is one itemare three items of business scheduled to be voted onconsidered for a vote at the 2016 Annual Meeting:

| · | | PROPOSAL 1: Election of nineseven Directors to the Board. Board (the “Election of Directors”); |

| · | | PROPOSAL 2: Ratification of the appointment of Grant Thornton as the Company’s independent auditor for the year ended December 31, 2018 (the “Auditor Ratification Proposal”); and |

| · | | PROPOSAL 3: The Approval, on a non-binding, advisory basis, of the executive compensation of our named executive officers (the “Executive Compensation Proposal”). |

We will also consider any other business that may properly come before the Annual Meeting or any adjournments or postponements thereof, including approving any such adjournment, if necessary. Please note that at this time we are not aware of any such business.

How does theour Board of Directors recommend that I vote?

Our Board recommends that you vote:

| · | | On PROPOSAL 1: “FOR” the election of each of its nominees to the Board.Board; |

| · | | On PROPOSAL 2: “FOR” the Auditor Ratification Proposal; and |

| · | | On PROPOSAL 3: “FOR” the Executive Compensation Proposal. |

What happens if additional matters are presented at the Annual Meeting?

Other than the itemitems of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the persons named as proxies will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting.

Am I eligible to vote?

You may vote your shares of Class B Stock at the Annual Meeting if you were a holder of record of Class B Stock aton the close of business on April 22, 2016. Your shares of Class B Stock are entitled to one vote per share.Record Date. At that time, there were 1,680,590 shares of Class B Stock outstanding, and approximately 350370 holders of record. Each share of Class B Stock is entitled to one vote on each matter properly brought before the Annual Meeting.

What if I own Class A Nonvoting Common Stock?

If you do not own any Class B Stock, then you have received this Proxy Statement only for your information. You and other holdersHolders of our Class A Nonvoting Common Stock (“Class A Stock”) have no voting rights with respect to the matters to be voted on at the Annual Meeting.

What should I do if I receive more than one copy of the proxy materials?

You may receive more than one copy of this Proxy Statement and multiple proxy cards or(or voting instruction cards.cards). For example, if you hold your shares in more than one brokerage account, you may receive a separate notice or a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you may receive more than one copy of this Proxy Statement or more than one proxy card.

To vote all of your shares of Class B Stock by proxy card, you must either (i) complete, date, sign and return each proxy card and(and voting instruction cardcard) that you receive or (ii) vote over the Internet or by telephone the shares represented by each notice that you receive.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Many stockholders of our Company hold their shares through a broker, bank, trustee or other nominee rather than directly in their own name. As summarized below, there are some differences in how stockholders of record and beneficial owners are treated.

Stockholders of Record. If your shares of Class B Stock are registered directly in your name with our Transfer Agent,transfer agent, you are considered the stockholder of record with respect to those shares and the proxy materials are being sent directly to you by Reading.you. As the stockholder of record of Class B Stock, you have the right to vote in person at the meeting. If you choose to do so, you can vote using the ballot provided at the Annual Meeting. Even if you plan to attend the Annual Meeting, we recommend that you vote your shares in advance as described below so that your vote will be counted if you decide later not to attend the Annual Meeting.

Beneficial Owner. If you hold your shares of Class B Stock through a broker, bank, trustee or other nominee rather than directly in your own name, you are considered the beneficial owner of such shares, held in street name and the proxy materials are being forwarded to you by your broker, bank, trustee or other nominee, who is considered the stockholder of record with respect to those shares. As the beneficial owner, you are also invited to attend the Annual Meeting. Because a beneficial owner is not the stockholder of record, you may not vote these shares in person at the Annual Meeting, unless you obtain a proxy from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the meeting. You will need to contact your broker, bank, trustee or nominee to obtain a proxy, and you will need to bring it to the Annual Meeting in order to vote in person.

How do I vote?

Proxies are solicited to give all holders of our Class B Stock who are entitled to vote on the matters that come before the Annual Meeting the opportunity to vote their shares, whether or not they attend the Annual Meeting in person. If you are a holder of record of shares of our Class B Stock, you have the right to vote in person at the Annual Meeting. If you choose to do so, you can vote using the ballot provided at the Annual Meeting. Even if you plan to attend the Annual Meeting, we recommend that you vote your shares in advance as described below so that your vote will be counted if you decide later not to attend the Annual Meeting. You can vote by one of the following manners:

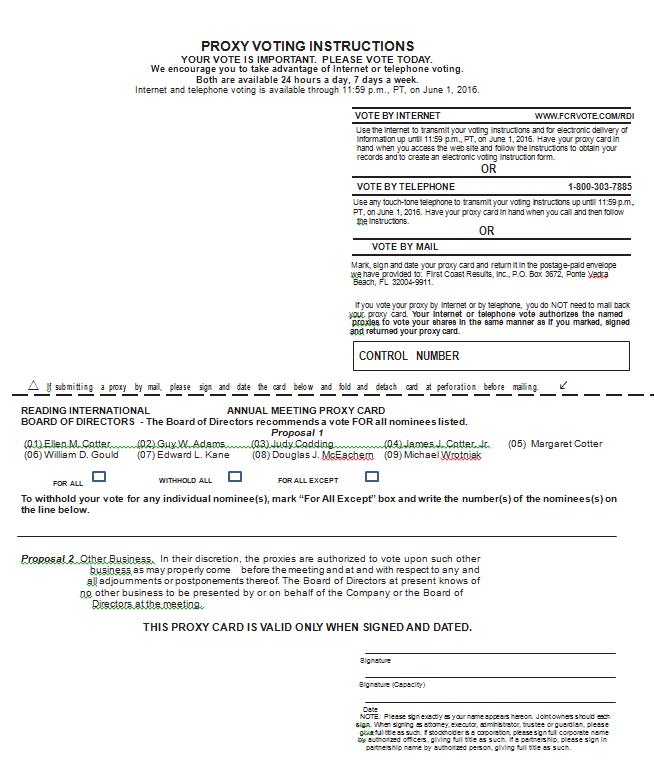

| · | | By Internet — Holders of record of our Class B Stock may submit proxies over the Internet by following the instructions on the proxy card. Holders of our Class B Stock who are beneficial owners may vote by Internet by following the instructions on the voting instruction card sent to them by their bank, broker, trustee or nominee. Proxies submitted by the Internet must be received by 11:59 p.m., local time, on June 1, 2016November 6, 2018 (the day before the Annual Meeting). |

| · | | By Telephone — Holders of record of our Class B Stock who live in the United States or Canada may submit proxies by telephone by calling the toll-free number on the proxy card and following the instructions. Holders of record of our Class B Stock will need to have the control number that appears on their proxy card available when voting. In addition, holders of our Class B Stock who are beneficial owners of shares living in the United States or Canada and who have received a voting instruction card by mail from their bank, broker, trustee or nominee may vote by phone by calling the number specified on the voting instruction card. Those stockholders should check the voting instruction card for telephone voting availability. Proxies submitted by telephone must be received by 11:59 p.m., local time, on June 1, 2016November 6, 2018 (the day before the Annual Meeting). |

| · | | By Mail — Holders of record of our Class B Stock who have received a paper copy of a proxy card by mail may submit proxies by completing, signing and dating their proxy card and mailing it in the accompanying pre-addressed envelope. Holders of our Class B Stock who are beneficial owners who have received a voting instruction card from their bank, broker or nominee may return the voting instruction card by mail as set forth on the card. Proxies submitted by mail must be received by the Inspector of Elections before the polls are closed at the Annual Meeting. |

| · | | In Person — Holders of record of our Class B Stock may vote shares held in their name in person at the Annual Meeting.Meeting until the polls are closed. You also may be represented by another person at the Annual Meeting by executing a proxy designating that person. Shares of Class B Stock for which a stockholder is the beneficial owner, but not the stockholder of record, may be voted in person at the Annual Meeting only if such stockholder obtains a proxy from the bank, broker or nominee that holds the stockholder’s shares, indicating that the stockholder was the beneficial owner as of the record dateRecord Date and the number of shares for which the stockholder was the beneficial owner on the record date.Record Date. |

Holders of our Class B Stock are encouraged to vote their proxies by Internet, telephone or by completing, signing, dating and returning a proxy card or voting instruction card, but not by more than one method. If you vote by more than one method, or vote multiple times using the same method, only the last-dated vote that is timely received by the Inspector of Elections will be counted, and each previous vote will be disregarded. If you vote in person at the Annual Meeting, you will revoke any prior proxy that you may have given. You will need to bring a valid form of identification (such as a driver’s license or passport) to the Annual Meeting to vote shares held of record by you in person.person.

What if my shares are held of record by an entity such as a corporation, limited liability company, general partnership, limited partnership or trust (an “Entity”), or in the name of more than one person, or I am voting in a representative or fiduciary capacity?

Shares held of record by an Entity. In order to vote shares on behalf of an Entity, you need to provide evidence (such as a sealed resolution) of your authority to vote such shares, unless you are listed as a record holder of such shares.

Shares held of record by a trust. The trustee of a trust is entitled to vote the shares held by the trust, either by proxy or by attending and voting in person at the Annual Meeting. If you are voting as a trustee, and are not identified as a record owner of the shares, then you must provide suitable evidence of your status as a trustee of the record trust owner. If the record owner is a trust and there are multiple trustees, then if only one trustee votes, that trustee’s vote applies to all of the shares held of record by the trust. If more than one trustee votes, the votes of the majority of the voting trustees apply to all of the shares held of record by the trust. If more than one trustee votes and the votes are split evenly on any particular Proposal,proposal, each trustee may vote proportionally the shares held of record by the trust.

Shares held of record in the name of more than one person. If only one individual votes, that individual’s vote applies to all of the shares so held of record. If more than one person votes, the votes of the majority of the voting individuals apply to all of such shares. If more than one individual votes and the votes are split evenly on any particular Proposal,proposal, each individual may vote such shares proportionally.

How will my shares be voted if I do not give specific voting instructions?

If you are a stockholder of record and you:

| · | | Indicate when voting on the Internet or by telephone that you wish to vote as recommended by our Board of Directors; or |

| · | | Sign and send in your proxy card and do not indicate how you want to vote, then the proxyholders, S. Craig Tompkins and Douglas McEachern, will vote your shares in the manner recommended by our Board of Directors as follows: FOR each of the seven nominees for director named below under “Proposal 1: Election of Directors;” FOR Proposal 2, the Auditor Ratification Proposal; FOR Proposal 3, the Executive Compensation Proposal; and in the discretion of our proxyholders on such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

What is a broker non-vote?non-vote and how is it counted?

If your shares are held by a broker on your behalf (that is, in “street name”), and you do not instruct the broker as to how to vote these shares on any “non-routine” proposals included in this Proxy Statement, your broker cannot exercise discretion to vote for or against those proposals. This would be a “broker non-vote,” and these shares will not be counted as having been voted on the applicable proposal. Applicable rules permit brokers to vote shares held in street name only on routine matters. Shares that are not voted on non-routineOnly Proposal 2, the Auditor Ratification Proposal is a “routine proposal.” All other matters such as the election of Directors or any proposed amendment of our Articles or Bylaws, are called broker non-votes. Broker non-votes will have no effect on thecontained in this Proxy Statement for submission to a vote for the election of Directors, but could affect the outcome of any matter requiring the approval of the holdersstockholders are considered “non-routine.” Accordingly, if your shares are held in street name and if you do not give you broker instructions as to how to vote, your broker will only be able to exercise its discretion in the case of an absolute majority of the Class B Stock. We areProposal 2, and will not currently aware of any matterbe permitted to be presented to the Annual Meeting that would require the approval of the holders of an absolute majority of the Class B Stock.vote on Proposal 1 or Proposal 3.

What routine matters will be voted on at the annual meeting?

None.

What non-routine matters will be voted on at the annual meeting?

The election of nine Directors to the Board is the only non-routine matter included among the Board’s proposals on which brokers may not vote, unless they have received specific voting instructions from beneficial owners of our Class B Stock.

How are abstentions“withhold authority” and broker non-votes“abstain” votes counted?

Abstentions and broker non-votes

Proxies that are voted to “withhold authority” or “abstain” are included in determiningonly to determine whether a quorum is present. In tabulatingIf “withhold authority” or “abstain” is selected with respect to the voting results forelection of directors, then such votes will have no impact on the itemselection of directors, as the seven nominees receiving the highest number of affirmative votes will be elected. If “withhold authority” or “abstain” is selected on a matter to be voted on at the 2016 Annual Meeting, shares that constitute abstentions and broker non-votes are not considered entitled to vote and will not affect the outcome of any matter being voted on at the meeting, unless the matter requires thefor which approval of the holders ofby a majority of the outstanding shares of Class B Stock.votes cast at the meeting is required (specifically, Proposal 2, the Auditor Ratification Proposal and Proposal 3,the Executive Compensation Proposal), then such a selection would similarly not have an effect on the vote, since “withhold authority” and “abstain” votes do not count as votes cast on that matter.

How can I change my vote after I submit a proxy?

If you are a stockholder of record, there are three ways you can change your vote or revoke your proxy after you have submitted your proxy:it has been submitted:

| · | | First, you may send a written notice to Reading International, Inc., postage or other delivery charges pre-paid, 6100 Center Drive,5995 Sepulveda Boulevard, Suite 900, Los Angeles,300, Culver City, CA, 90045,90230, c/o Secretary of the Annual Meeting, Secretary, stating that you revoke your proxy. To be effective, the Inspector of Elections must receive your written notice prior to the closing of the polls at the Annual Meeting. |

| · | | Second, you may complete and submit a new proxy in one of the manners described above under the caption, “How do I vote?” Any earlier proxies will be revoked automatically. |

| · | | Third, you may attend the Annual Meeting and vote in person. Any earlier proxy will be revoked. However, attending the Annual Meeting without voting in person will not revoke your proxy. |

How will youwe solicit proxies and who will pay the costs?

We will pay the costs of the solicitation of proxies. We may reimburse brokerage firms and other persons representing beneficial owners of shares for expenses incurred in forwarding the voting materials to their customers who are beneficial owners and obtaining their voting instructions. In addition to soliciting proxies by mail, our board members, officers and employees may solicit proxies on our behalf, without additional compensation, personally or by telephone.

Is there a list of stockholders entitled to vote at the Annual Meeting?

The names of stockholders of record entitled to vote at the Annual Meeting will be available at the Annual Meeting and for ten days prior to the Annual Meeting, at our corporate offices, 6100 Center Drive,5995 Sepulveda Boulevard, Suite 900, Los Angeles,300, Culver City, CA 9004590230 between the hours of 9:00 a.m. and 5:00 p.m., local time, for any purpose relevant to the Annual Meeting. To arrange to view this list during the times specified above, please contact the Secretary of the Company.Annual Meeting at (213) 235-2240.

What constitutes a quorum?

The presence in person or by proxy of the holders of record of a majority of our outstanding shares of Class B Stock entitled to vote will constitute a quorum at the Annual Meeting. Each share of our Class B Stock entitles the holder of record to one vote on all matters to come before the Annual Meeting.

How are votes counted and who will certify the results?

First Coast Results, Inc. will act as the independent Inspector of Elections and will count the votes, determine whether a quorum is present, count the votes, evaluate the validity of proxies and ballots, and certify the results. A representative of First Coast Results, Inc. will be present at the Annual Meeting. The final voting results will be reported by us on a Current Report on Form 8-K to be filed with the SECSecurities and Exchange Commission (the “SEC”) within four business days following the Annual Meeting.

What is the vote required for a Proposalproposal to pass?

Proposal 1 (the Election of Directors): The nineseven nominees for election as Directors at the Annual Meeting who receive the highest number of “FOR” votes for the available Board seats will be elected as Directors. This is called plurality voting. Unless you indicate otherwise, the persons named as your proxies will vote your shares FOR all the nominees for Directors named in Proposal 1. If your shares are held by a broker or other nominee and you would like to vote your shares for the election of Directors in Proposal 1, you must instruct the broker or nominee to vote “FOR” for each of the candidates for whom you would like to vote. If you give no instructions to your broker or nominee, then your shares will not be voted. Ifvoted and will not be counted in determining the election. Likewise, if you instruct your broker or nominee to “WITHHOLD,” then your vote will not be counted in determining the election.

Proposal 2 (the Auditor Ratification Proposal): This proposal requires the “FOR” vote of a majority of the votes cast in order to pass.

Proposal 3 (the Executive Compensation Proposal): This proposal requires the “FOR” vote of a majority of the votes cast to pass.Because your vote is advisory, it will not be binding on us, our Board or our Compensation and Stock Options Committee (the “Compensation Committee”). However, the Board and our Compensation Committee, as applicable, will review the voting results and take them into consideration when making future decisions and recommendations regarding executive compensation.

Only votes ”FOR”“FOR” on Proposal 1 at the Annual Meeting(the Election of Directors) will be counted since directors are elected by plurality vote. The nominees receiving the highest total votes for the number of seats on the Board will be elected as directors. Only votes “FOR” and “AGAINST” will be counted for Proposal 2 (the Auditor Ratification Proposal) since abstentions are not counted as votes castcast. Only votes “FOR” and abstentions; votes withheld“AGAINST” will be counted for Proposal 3 (the Executive Compensation Proposal), since abstentions and broker non-votes willare not be counted for voting purposes.as votes cast.

Is my vote kept confidential?

Proxies, ballots and voting tabulations identifying stockholders are kept confidential and will not be disclosed to third parties, except as may be necessary to meet legal requirements.

How will the Annual Meeting be conducted?

In accordance with our Bylaws, Ellen M. Cotter, as the Chair of the Board, will be the Presiding Officer of the Annual Meeting. S. Craig Tompkins has been designated by the Board to serve as Secretary for the Annual Meeting.

Ms. Cotter and other members of management willmay address attendees following the Annual Meeting. Stockholders desiring to pose questions to our management are encouraged to send their questions to us, care of the Secretary of the Annual Meeting, Secretary, in advance of the Annual Meeting, so as to assist our management in preparing appropriate responses and to facilitate compliance with applicable securities laws.

The Presiding Officer has broad authority to conduct the Annual Meeting in an orderly and timely manner. This authority includes establishing rules for stockholders who wish to address the meeting or bring matters before the

Annual Meeting. The Presiding Officer may also exercise broad discretion in recognizing stockholders who wish to speak and in determining the extent of discussion on each item of business. In light of the need to conclude the Annual Meeting within a reasonable period of time, there can be no assurance that every stockholder who wishes to speak will be able to do so. The Presiding Officer has authority, in her discretion, to at any time recess or adjourn the Annual Meeting. Only stockholders are entitled to attend and address the Annual Meeting. Any questions or disputes as to who may or may not attend and address the Annual Meeting will be determined by the Presiding Officer.

Only such business as shall have been properly brought before the Annual Meeting shall be conducted. Pursuant to our governing documents and applicable Nevada law, in order to be properly brought before the Annual Meeting, such business must be brought by or at the direction of (1) the Chair, (2) our Board, or (3) holders of record of our Class B Stock. At the appropriate time, anyAny stockholder who wishes to address the Annual Meeting shouldmay do so only upon being recognized by the Presiding Officer.

CORPORATE GOVERNANCE

Passing of our Lead Independent Director

We are deeply saddened to announce the death of Mr. William D. Gould on August 6, 2018. Mr. Gould was a member of the Board since 2004 and, at the time of his death, served as our Lead Independent Director.

Our Board acknowledges with appreciation Mr. Gould’s deep commitment, long service and extensive contributions to our Company. Mr. Gould will be greatly missed by all of his colleagues and friends here at Reading.

Our Board intends to consider the issue of the appointment of a new Lead Independent Director at its meeting immediately following the Annual Meeting. No interim Lead Independent Director has been appointed.

Director Leadership Structure

Ellen M. Cotter is our current Chair, President and Chief Executive Officer. Ellen M. Cotter has been an executive with our Company for more than 1820 years, focusingand prior to her appointment in 2015 as our President and Chief Executive Officer, she principally focused on the cinema operations aspects of our business. During this time period, we have grownShe has cinema operating experience in all jurisdictions in which our Domestic Cinema Operations from 42Company currently operates. On the real estate side, she has been involved in the acquisition and development of all of our domestic cinema locations brought on line since she joined our Company. Historically our Board has chosen to 248 screens and our cinema revenues have grown from US $15.5 million to US $132.9 million. Historically, we have combinedcombine the roles of the Chair and the Chief Executive Officer, except for the period from August 2014 until June 12, 2015, when the roles of Chair and Chief Executive Officer were held by two executives of the Company following the resignation for health reasons of our founder, James J. Cotter, Sr.Officer. At the present time, weour Board continues to believe that the combinedcombination of these roles is in the best interests of our Company and our stockholders as such a structure (i) allowallows for consistent leadership, (ii) continuecontinues the tradition of having a Chair and Chief Executive Officer, who is also a controlling stockholdermember of the Cotter Family (which currently controls over 70% of the voting power of our Company, a leadership structure in which many of our stockholders have invested), and also (iii) reflectreflects the reality of our status as a “controlled company” under relevant NASDAQ Listing RulesRules.

Margaret Cotter is our current Vice-Chair and she also serves as our Executive Vice President – Real Estate Management and Development - NYC. Margaret Cotter has been responsible for the operation of our live theaters for more than 1718 years and has for more than the past five6 years been actively involved inleading the re-development of our New York properties. On March 10, 2016,In recent periods, her area of responsibility has expanded to include oversight of our Board appointed Margaret Cotter as Executive Vice President-Real Estate Managementdevelopment efforts with respect to our other East Coast and Development-NYC.Midwestern properties, including those in Philadelphia and Chicago.

Ellen M. Cotter has a substantial stake in our business, owning directly 799,765817,533 shares of Class A Stock and 50,000 shares of Class B Stock. Margaret Cotter likewise has a substantial stake in our business, owning directly 804,173814,973 shares of Class A Stock and 35,100 shares of Class B Stock. In addition, Ellen M. Cotter and Margaret Cotter are the Co-Executors of their father’s (Jamesthe Estate of James J. Cotter, Sr.) estate (the “Cotter Estate”) and Co-Trustees of a trustthe James J. Cotter, Sr. Living Trust (the “Cotter Living Trust”). Margaret Cotter is, in addition, the co-trustee (with James J. Cotter, Jr.,) of the trust established by Mr. James J. Cotter, Sr., for the benefit of his heirs.grandchildren (the “Cotter Grandchildren’s Trust”) which holds 274,390 shares of Class A Stock and is the sole trustee of the sub-trust to be formed under the Cotter Living Trust (the “Reading Voting Trust”) to hold for the benefit of the grandchildren of James J. Cotter, Sr., all of the Class B Stock currently owned by the Cotter Estate and the Cotter Living Trust. Together, theyEllen Cotter and Margaret Cotter have sole or shared voting control over an aggregate of 1,208,988 shares or 71.9% of our Class B Stock. Mr. James J. Cotter, Jr., the brother of Ellen M. Cotter and Margaret Cotter, have informedis designated as the Board that they intend to vote the shares beneficially held by them for eachsuccessor trustee of the nine nominees namedReading Voting Trust, in this Proxy Statement for election to the Board under Proposal 1.

James Cotter, Jr. allegesevent that he has the right to vote the shares held by the Cotter Trust. The Company believes that, under applicable Nevada Law, where there are multiple trustees of a trust that is a record owner of voting shares of a Nevada corporation, and more than one trustee votes, the votes of the majority of the voting trustees apply to all of the shares held of record by the trust. If more than one trustee votes and the votes are split evenly on any particular proposal, each trustee may vote proportionally the shares held of record by the trust. Ellen M. Cotter and Margaret Cotter who collectively constitute a majorityshould be unable or unwilling to continue as the trustee of the Co-Trustees of the Cotter Trust, have informed thethat trust.

Director Independence and Board that they intend to vote the shares held by the Cotter Trust for each of the nine nominees named in this Proxy Statement for election to the Board under Proposal 1. Accordingly, the Company believes that Ellen M. Cotter and Margaret Cotter collectively have the power and authority to vote all of the shares of Class B Stock held of record by the Cotter Trust, which, when added to the other shares they report as being beneficially owned by them, will constitute 71.9% of the shares of Class B Stock entitled to vote for Directors at the Annual Meeting.Oversight Structure

The Company has elected to take advantage of the “controlled company” exemption under applicable listing rules of Thethe NASDAQ Capital Stock Market (the “NASDAQ Listing Rules”). Accordingly, the Company is exempted from the requirement to have an independent nominating committee and to have a board of directors composed of at least a majority of

independent directors, as that term is defined in the NASDAQ Listing Rules and SEC Rules (“Independent Directors”). We are nevertheless and to have an independent nominating committee. Nevertheless, our Board has for many years had a majority of Independent Directors and is nominating a majority of Independent Directors for election to our Board. In determining who is an Independent Director, we follow the definition in section 5605(a)(2) of the NASDAQ Listing Rules. Under such rules, we consider the following directors who served in 2017 to be independent: Guy Adams, Dr. Judy Codding, William D. Gould, Edward L. Kane, Douglas McEachern and Michael Wrotniak. Our Board annually reviews the independence of our directors.

We currently have an Audit and Conflicts Committee (the “Audit Committee”) and a Compensation and Stock Options Committee (“Compensation Committee”) composed entirely of Independent Directors. William D. Gould served up to the date of his passing, August 6, 2018, as our Lead Independent Director. It is currently anticipated that an Independent Director will be appointed to this position at the annual organizational meeting of our Board following the Annual Meeting. Historically, our Lead Independent Director chairs meetings of the Independent Directors (typically held as a separate part of each board meeting) and acts as liaison between our Chair, President and Chief Executive Officer and our Independent Directors. We also currently have a four memberfour-member Executive Committee composed of our Chair, and Vice-Chair and Messrs. Guy W. Adams and Edward L. Kane. Due toAs a consequence of this structure, the concurrence of at least one non-management member of the Executive Committee is required in order for the Executive Committee to take action.

Our Board, since Ellen Cotter was appointed our Chief Executive Office in 2015, has (i) adopted a best practices charter for our Compensation Committee, (ii) adopted a new best practices charter for our Audit Committee, (iii) completed, with the assistance of compensation consultants Willis Towers Watson and outside counsel Greenberg Traurig, LLP, a complete review of our compensation practices, in order to bring them into alignment with current best practices, (iv) adopted a new Code of Business Conduct and Ethics, and a Supplemental Insider Trading Policy restricting trading in our stock by our Directors and executive officers and (v) updated our Whistleblower Policy.

Last year, our Board adopted a Stock Ownership Policy, setting out minimum stock ownership levels for our directors and senior executives, and earlier this year.

In recognition of the special risks involved with technology and cyber security, Director Guy Adams has been appointed to serve as our Lead Technology and Cyber Risk Director. In this role, Director Adams serves as our Board’s liaison with our CEO, CFO and General Counsel in connection with the assessment of our Company’s technology and cyber security needs and the implementation of appropriate policies and procedures to meet those needs. He ensures that relevant information is brought to our Board, and coordinates the timely presentation of such information to and facilitates the consideration of such information by all directors. He also coordinates with our management timely and appropriate director education with respect to such matters to enhance director understanding of the issues involved and the options available to our Company. In preparation for this role, Director Adams in 2018 completed the Cyber-Risk Oversight course presented by the National Association of Corporate Directors.

In 2017, our Board also established a Special Independent Committee to, among other things, review, consider, deliberate, investigate, analyze, explore, evaluate, monitor and exercise general oversight of any and all activities of the Company directly or indirectly involving, responding to or relating to the purported derivative litigation brought by Mr. James J. Cotter, Jr. in Nevada against our current nominees (while Mr. Cotter, Jr.’s claims have all been dismissed with prejudice on summary judgment. Mr. Cotter, Jr. has appealled the Nevada District Court’s judgment), the employment arbitration between our Company and Mr. James J. Cotter, Jr. relating to the termination of Mr. Cotter, Jr. as our president and chief executive officer, the litigation between Ms. Ellen Cotter and Ms. Margaret Cotter relating to the management of the Cotter Living Trust and the Reading Voting Trust and the voting and disposition of the Class B Stock held by the Cotter Living Trust and to be held by the Reading Voting Trust, and any other litigation or arbitration matters involving any one or more of Ms. Ellen Cotter, Ms. Margaret Cotter, Mr. James J. Cotter, Jr., the Cotter Estate and/or the Cotter Living Trust. Directors Judy Codding and Douglas McEachern currently serve on this Special Independent Committee. On April 13, 2018, our Board appointed a Special Litigation Committee comprised of Directors Codding, Gould and McEachern to consider whether or not the continuation of the derivative litigation was in the best interests of the Company. The work of that committee has been mooted by the above referenced dismissal with prejudice of that litigation.

We believe that our Directors bring a broad range of leadership experience to our Company and regularly contribute to the thoughtful discussion involved in effectively overseeing the business and affairs of the Company. We believe that all Board members are well engagedwell-engaged in their responsibilities and that all Board members express their views and consider the opinions expressed by other Directors. A majority of our Board is independent under the NASDAQ Listing Rules and SEC rules, and William D. Gould serves as the Lead Independent Director among our Independent Directors (“Lead Independent Director”). In that capacity, Mr. Gould chairs meetings of the Independent Directors and acts as liaison between our Chair, President and Chief Executive Officer and our Independent Directors. Our Independent Directors are involved in the leadership structure of our Board by serving on our Executive Committee, our Audit Committee and theour Compensation Committee, each of which has a separate independent Chair.chair. Nominations to our Board for the Annual Meeting were made by our entire Board, consisting of a majority of Independent Directors. Each of the nominees received the unanimous vote of the Independent Directors, each such nominee abstaining with respect to his or her own nomination.

Since

Certain Potential Change of Control Considerations

While our last Annual MeetingCompany is currently a controlled company under applicable NASDAQ Listing Rules with over 70% of Stockholders, we have (i) adopted a best practices Charter for our Compensation Committee, (ii) adopted a new best practices Charter for our Audit Committee, and (iii) completed, with the assistance of compensation consultants Willis Towers Watson and outside counsel Greenberg Traurig, LLP, a complete reviewvoting power of our compensation practices, in order to bring them into alignment with current best practices. Immediately prior toCompany being currently held by Ellen Cotter and Margaret Cotter, the ongoing control of our last Annual Meeting we adopted a new supplemental policy restricting trading in our stockCompany by our Directorsthe Cotter Family is currently being challenged by James J. Cotter, Jr., the brother of Ellen Cotter and executive officers. Margaret Cotter. Certain information regarding this challenge is set forth below.

Management Succession

On August 7,Up until his death on September 13, 2014, James J. Cotter, Sr., our then controlling stockholder, Chair and Chief Executive Officer, resigned from all positions at our Company, and passed away on September 13, 2014. Upon his resignation, Ellen M. Cotter was appointed Chair, Margaret Cotter, her sister, was appointed Vice Chair and James Cotter, Jr., her brother, was appointed Chief Executive Officer, while continuing his position as President.

On June 12, 2015, the Board terminated the employment of James Cotter, Jr. as our President and Chief Executive Officer, and appointed Ellen M. Cotter to serve as the Company’s interim President and Chief Executive Officer. The Board established an Executive Search Committee (the “Search Committee”) initially composedfather of Ellen M. Cotter, Margaret Cotter, and Independent Directors William GouldJames J. Cotter, was our controlling stockholder, having the sole power to vote approximately 66.9% of the outstanding Class B Stock. Under applicable Nevada Law, a stockholder holding more than 2/3rds of the Company’s voting stock has the power at any time, with or without cause, to remove any one or more directors (up to and Douglas McEachern,including the entire board of directors) by written consent taken without a meeting of the stockholders.

Following the death of Mr. Cotter, Sr., disputes arose among Ellen Cotter and retained Korn FerryMargaret Cotter, on the one hand, and James J. Cotter, Jr., on the other hand, concerning the voting control and disposition of those shares. These disputes initially resulted in an action brought by Ellen Cotter and Margaret Cotter on February 5, 2015 in the Superior Court of the State of California, County of Los Angeles (the “California Superior Court”), in the case captioned In re James J. Cotter Living Trust dated August 1, 2000 (Case No. BP159755) (the “Trust Case”), to evaluate candidatesdetermine which of two trust documents controlled the Cotter Living Trust and the Reading Voting Trust. On March 23, 2018, the California Superior Court ruled that the trust document advocated by Mr. Cotter, Jr., was invalid. That ruling has become final and non-appealable. Accordingly, it has now been judicially established that Ellen Cotter and Margaret Cotter are the Co-Trustees of the Cotter Living Trust, and Margaret Cotter is the sole Trustee of the Reading Voting Trust to be formed under the Cotter Living Trust to eventually hold Class B Voting Stock representing approximately 66.9% of the outstanding voting stock of our Company.

Prior to this ruling, Mr. Cotter Jr., on or about February 8, 2017, brought an ex parte motion in the Trust Case seeking the appointment of a trustee ad litem to market and potentially sell the voting stock to be held by the Reading Voting Trust. Mr. Cotter, Jr.’s, petition did not contemplate a sale of our entire Company (it proposed only the sale of the controlling block of Class B Stock anticipated to be used to fund the Reading Voting Trust), nor did it provide any way for stockholders generally to benefit from such a change of control transaction or any protections for minority stockholders. As previously disclosed, our Board has adopted a long-term business strategy for our Company: a strategy which, among other things, our Board believes will allow stockholders generally to realize the benefit of the build out of our real estate portfolio, and the execution of our business plan for our international cinema operations. Accordingly, our Board has determined that it would not be appropriate to put our Company up for sale at this time. Mr. Cotter, Jr.’s pleading in the Trust Case includes no provision for the Chief Executive Officer position. Ellen M. Cotter resigned from the Search Committee when she concluded that she was a serious candidate for the position. Korn Ferry screened over 200 candidatesprotection or advancement of our Company’s business plan and ultimately presented six external candidates to the Search Committee. The Search Committee evaluated those external candidates and Ellen M. Cotter in meetings in December 2015 and January 2016, considering numerous factors, including, among others, the benefits of having a President and Chief Executive Officer who has the confidence of the existing senior management team, Ms. Cotter’s prior performance as an executive ofsubjects the Company and her performanceits minority stockholders to the risk of sale to a buyer whose interests may be contrary to, or ignore those of, other stockholders. In light of our Board’s determination that it would be in the best interests of our Company and our stockholders generally to continue to pursue our Company’s business plan, and not to sell the Company at this time, the potential disruption to the achievement of that business plan and to the business and affairs of our Company generally if there were to be a change of control transaction at this time, and the commitment of Ellen Cotter and Margaret Cotter to the pursuit and fulfilment of that business plan, our Company has made filings in the California Superior Court opposing such an appointment of a trustee ad litem.

On March 23, 2018, the California Superior Court ruled that it would appoint a temporary trustee ad litem (the “TTAL”) “with the narrow and specific authority to obtain offers to purchase the RDI stock in the voting trust, but not to exercise any other powers without court approval, specifically the sale of the company or any other powers possessed by the trustees.” No TTAL has been appointed to date.

On April 12, 2018, following the application for a writ by Ellen Cotter and Margaret Cotter as the interim PresidentTrustees of the Cotter Living Trust, and Chief Executive OfficerMargaret Cotter as the Trustee of the Reading Voting Trust, the California Court of Appeals stayed all trial court proceedings and issued its Order to Show Cause as to why it should not vacate the California Superior Court’s Order that a TTAL be appointed to market the above referenced Class B Stock and enter a different order denying Mr. Cotter, Jr.’s ex parte petition seeking a TTAL. It is not currently anticipated that the Court of Appeals will rule on its Order to Show Cause prior to the date of our Annual Meeting. Ellen Cotter and Margaret Cotter have based their appeal on, among other things, their interpretation (as set out in their briefs to the Court of Appeals) of the applicable trust documents as clearly directing that control of our Company be retained within the Cotter Family for as long as possible.

As of June 30, 2018, according to the books of the Company, the qualifications, experience and compensation demandsCotter Living Trust held of record 696,080 shares of our Class B Stock constituting approximately 41.4% of the external candidates,voting power of our outstanding capital stock. According to the books of the Company, the Cotter Estate as of that date held of record an additional 427,808 shares of Class B Stock, constituting approximately 25.5% of the voting power of our outstanding capital stock. We are advised, based upon public filings made by one or more of Ellen Cotter, Margaret Cotter and James J. Cotter, Jr. (the “Cotter Filings”) that the Class B Stock currently held of record by the Cotter Estate will eventually pour over into the Cotter Living Trust where it will then be placed in the Reading Voting Trust. At the present time, however, such Class B Stock is held of record by the Cotter Living Trust and the benefitsCotter Estate, respectively. Ellen Cotter and detriments of having a Chair, President and Chief Executive Officer who isMargaret Cotter are also a controlling stockholderthe Co-Executors of the Company. Cotter Estate.

The Search Committee recommendedCalifornia Superior Court, in the Trust Case, has jurisdiction over the Cotter Living Trust, which as described in more detail above, currently owns 41.4% of our Class B Stock, and, at such time as the Cotter Estate is probated, may receive up to an additional 25.5% of our Class B Stock, and accordingly, has jurisdiction over a potentially controlling block of our voting power. Should the California Superior Court order the sale of the Cotter Living Trust’s Class B Stock and such sale be completed, then there may be a change of control of our Company, depending on, among other things, who the ultimate purchaser(s) of such shares might be, the number of shares of Class B Stock distributed by the Cotter Estate to the Cotter Living Trust, and whether the California Superior Court orders a sale of all or only some portion to the Class B Stock held by the Cotter Living Trust.

While our Company is not a party to the Trust Case, the rulings of the Superior Court in that case could have a potential material impact upon, among other things, (a) the control of our Company, (b) the future composition of our Board and senior executive management team, and (c) our Company’s continued pursuit of the Strategic Plan articulated in our various filings with the SEC, at our prior stockholder meetings, and at various analyst presentations. To date, the California Superior Court has accepted our submissions and allowed us to be involved in the Trust Case, so as to provide us an opportunity to address issues of concern to our Company and our stockholders generally. However, no assurances can be given as to the outcome of the Trust Case and we are advised that we have no standing to appear in the current appeal.

As we are advised by counsel that it is unlikely that the Court of Appeals will rule on its Order to Show Cause before our Annual Meeting and as, even in the event that the Court of Appeals were to determine to allow the appointment of a TTAL, a trial court hearing would still be required before any binding agreement to sell such shares could be entered into, we do not anticipate that any material change in the holdings of the Class B Stock held by the Cotter Trust will occur prior to our Annual Meeting, if ever. We are advised by Ellen M. Cotter as permanent President and Chief Executive Officer andMargaret Cotter that, if there is a sale of the Class B Stock held by the Cotter Voting Trust, they intend to be the buyers of such shares.

Our Board appointed her on January 8, 2016, with seven Directors voting yes, one Director (Jameshas not re-nominated Mr. Cotter, Jr.) voting no,, for election to our Board, and Ellen M. Cotter abstaining.has instead reduced the size of our Board to seven (7) members, effective upon completion of the election at our upcoming Annual Meeting.

For more information about the above referenced matters please see the disclosure in our Annual Report on Form 10-K filed on March 16, 2018, under the “Part I, Item 1A-“Risk Factors—Ownership and Management Structure, Corporate Governance, and Change of Control Risks,” and Part II, Item 8 (Financial Statements and Supplementary Data) – Note 12 – “Commitments and Contingencies to the Consolidated Financial Statements” and our Form 10-K/A filed on April 30, 2018 and our Quarterly Report on Form 10-Q filed on August 9, 2018.

Board’s Role in Risk Oversight

Our management is responsible for the day-to-day management of risks we face as a Company, while our Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, our Board has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

The Board plays an important role in risk oversight at Reading through direct decision-making authority with respect to significant matters, as well as through the oversight of management by the Board and its committees. In particular, the Board administers its risk oversight function through (1) the review and discussion of regular periodic reports by the Board and its committees on topics relating to the risks that the Company faces, (2) the required approval by the Board (or a committee of the Board) of significant transactions and other decisions, (3) the direct oversight of specific areas of the Company’s business by the Audit Committee and the Compensation Committee with input from the Lead Technology and Cyber Risks Director, and (4) review of regular periodic reports from the auditors and other outside consultants regarding various areas of potential risk, including, among others, those relating to our internal control over financial reporting. The Board also relies on management to bring significant mattersrisks impacting the Company to the attention of the Board.

“Controlled Company” Status

Under section 5615(c)(1) of the NASDAQNasdaq Listing Rules, a “controlled company” is a company in which more than 50% of the voting power for the election of Directors is held by an individual, a group, or another company. Together, Ellen M. Cotter and Margaret Cotter beneficially own 1,208,988 shares or 71.9% of our Class B Stock. Our Class A Stock does not have voting rights. Based on advice of counsel, our Board has determined that the Company is therefore a “controlled company” within the NASDAQNasdaq Listing Rules.

After reviewing the benefits and detriments of taking advantage of the exemptions to certain corporate governance rules available to a “controlled company” as set forth in the NASDAQNasdaq Listing Rules, our Board has determined to take advantage of those exemptions. In reliance on a “controlled company” exemption, the Company does not maintain a separate standing Nominating Committee. The Company nevertheless at this time maintains a full Board composed of a majority of Independent Directors, and a fully independentan Audit Committee and Compensation Committee each composed entirely of Independent Directors, and has no present intention to vary from that structure. Our Board, consisting of a majority of Independent Directors, approved each of the nominees for our 20162018 Annual Meeting. See “Consideration and Selection of the Board's Director Nominees,” below. Each of the nominees, in each case the nominee abstaining from the vote, was approved by at least a majority of our Directors.

Board Committees

Our Board has a standing Executive Committee, Audit Committee, and Compensation Committee. The Tax Oversight Committee has been inactive since November 2, 2015 in anticipation that its functions would be moved to the Audit Committee under its new charter. That new charter was approved on May 5, 2016. These committees other than the Tax Oversight Committee, are discussed in greater detail below.

Executive Committee. TheOur Executive Committee operates pursuant to a Charterresolution adopted by our Board. Our Executive CommitteeBoard and is currently composed of Ms. Ellen M. Cotter, Ms. Margaret Cotter and Messrs. Guy W. Adams and Edward L. Kane. Pursuant to its Charter,that resolution, the Executive Committee is authorized, to the fullest extent permitted by Nevada law and our Bylaws, to take any and all actions that could have been taken by the full Board between meetings of the full Board. The Executive Committee held sixdid not hold any meetings during 2015.2017.

Audit Committee. TheOur Audit Committee operates pursuant to aits, Charter adopted by our Board thatwhich is available on our website at http://www.readingrdi.com/Committee-Charters.about/#committee-charters. The Audit Committee reviews, considers, negotiates and approves or disapproves related party transactions (see the discussion in the section entitled “Certain Relationships and Related Party Transactions” below). In addition, the Audit Committee is responsible for, among other things, (i) reviewing and discussing with management the Company’s financial statements, earnings press releases and all internal controls reports, (ii) appointing, compensating and overseeing the work performed by the Company’s independent auditors, and (iii) reviewing with the independent auditors the findings of their audits.audits; and (iv) reviewing, considering, negotiating and approving or disapproving related party transactions (see the discussion in the section entitled “Certain Relationships and Related Party Transactions” below).

Our Board has determined that the Audit Committee is composed entirely of Independent Directors (as defined in section 5605(a)(2) of the NASDAQNasdaq Listing Rules) and Rule 10A-3(b)(1) of the Exchange Act., and that Mr. Douglas McEachern, the Chair of our Audit Committee, is an Independent Director who meets the foregoing guidelines and is qualified as an Audit Committee Financial Expert. Our Audit Committee is currently composed of Mr. McEachern, who serves as Chair, Mr. Edward L. Kane and Mr. Michael Wrotniak. Mr. Timothy Storey, who served on our Board through October 11, 2015, served on our Audit Committee through the same date. The Audit Committee held fournine meetings during 2015.2017.

Compensation Committee. Our Board has established a standing Compensation Committee consisting of three of our non-employeeIndependent Directors, and is currently composed of Mr. Edward L. Kane, who serves as Chair, Dr. Judy Codding and Mr. McEachern. Mr. Storey served on our Compensation Committee through October 11, 2015 and Mr. Adams served

through May 14, 2016.Michael Wrotniak. As a Controlled Company,controlled company, we are exempt from the NASDAQ Listing Rules regarding the determination of executive compensation solely by Independent Directors.independent directors, who additionally meet the heightened independence requirements specific to compensation committee members. Notwithstanding such exemption, we adopted a Compensation Committee charter on March 10, 2016 requiring our Compensation Committee members to meet the independence rules and regulations of the SEC and the NASDAQ Stock Market. As a part of the transition to this new compensation committee structure, the compensation for 2016 of the President, Chief Executive Officer, all Executive Vice Presidents, and all Managing Directors was reviewed and approved by the Board at that March 10, 2016 meeting.

TheNasdaq. Our Compensation Committee charter is available on our website at http://www.readingrdi.com/charter-of-our-compensation-stock-options-committee/. Theabout/#committee-charters.

Our Compensation Committee evaluates and makes recommendations to the full Board regarding the compensation of our Chief Executive Officer. UnderPursuant to its new Charter, the Compensation Committee has delegated authority to establish the compensation for all executive officers other than the President and Chief Executive Officer; provided that compensation decisions related to members of the Cotter Family remain vested in the full Board. In addition, the Compensation Committee, among other things, (i) establishes the Company’s general compensation philosophy and objectives (in consultation with management), (ii) approves and adopts on behalf of the Board incentive compensation and equity-based compensation plans, subject to stockholder approval as required, and (iii) performs other compensation related functions as delegated by our Board. The Compensation Committee held threeten meetings during 2015.2017.

Other Board Committees. Our Board has also appointed a Special Independent Committee and a Special Litigation Committee, whose functions have been described early in these materials.

Consideration Consideration and Selection of the Board’s Director Nominees

The Company has elected to take the “Controlled Company”“controlled company” exemption under applicable NASDAQ Listing Rules. Accordingly, the Company does not maintain a standing Nominating Committee. Our Board, consisting of a majority of Independent Directors, approved each of the Board nominees for our 20162018 Annual Meeting.

Our Board does not have a formal policy with respect to the consideration of Director candidates recommended by our stockholders. No non-Director stockholder has, in more than the past ten years, made any formal proposal or recommendation to the Board as to potential nominees. Neither our governing documents nor applicable Nevada law place any restriction on the nomination of candidates for election to our Board directly by our stockholders. In light of the facts that (i) we are a Controlled Companycontrolled company under the NASDAQ Listing Rules and exempted from the requirements for an independent nominating process, and (ii) our governing documents and Nevada law place no limitation upon the direct nomination of Director candidates by our stockholders, our Board believes there is no need for a formal policy with respect to Director nominations.

Our Board will consider nominations from our stockholders, provided written notice is delivered to our Secretary at our principal executive offices not less than 120 days prior to the first anniversary of the date that this Proxy Statement is sent to stockholders, or such earlier date as may be reasonable in the event that our annual stockholders meeting is moved more than 30 days from the anniversary of the 2016 Annual Meeting. Such written notice must set forth the name, age, address, and principal occupation or employment of such nominee, the number of shares of our common stock that are beneficially owned by such nominee, and such other information required by the proxy rules of the SEC with respect to a nominee of our Board.

Our Directors have not adopted any formal criteria with respect to the qualifications required to be a Director or the particular skills that should be represented on our Board, other than the need to have at least one Director and member of our Audit Committee who qualifies as an “audit committee financial expert,“Audit Committee Financial Expert,” and have not historically retained any third party to identify or evaluate or to assist in identifying or evaluating potential nominees. We have no policy of considering diversity in identifying Director nominees.

Our Board oversees risk by remaining well-informed through regular meetings with management and our Chair’s personal involvement in our day-to-day business including any matters requiring specific risk management oversight. Our Chair, President and Chief Executive Officer chairs regular senior management meetings, which are typically held weekly, one addressing domestic issues and the other addressing overseas issues. The risk oversight function of our Board is enhanced by the fact that our Audit Committee is comprised entirely of Independent Directors.

We encourage, but do not require, our Board members to attend our Annual Meeting. All of our nine then-incumbent Directors attended last year’s annual meeting.

Following a review of the experience and overall qualifications of the Director candidates, on August 30, 2018, our Board resolved to nominate, each of theseven incumbent Directors named in Proposal 1 for election as Directors of the Company at our 20162018 Annual Meeting.

The Board, in reaching the decision to nominate Mr. James Cotter, Jr. for re-election to the Board, took a number of factors into consideration. Without attempting to place any particular priority on any particular consideration, the Board considered Mr. Cotter Jr.’s pending litigation against certain of the other Directors; his pending arbitration proceedings with the Company related to his prior termination as the President and Chief Executive Officer of our Company; his litigation against the Company seeking reimbursement and future advancement of his legal fees and expenses incurred in such arbitration proceedings; the Board’s June 2015 determination to terminate Mr. Cotter, Jr. as our Company’s President and Chief Executive Officer; the potential that this personal action and legal proceedings have and will likely continue to cause dissension among Board members and impact the otherwise collegial nature of Board meetings; Mr. Cotter, Jr.’s longevity on the Board and his broad knowledge of our Company; Mr. Cotter, Jr.’s beneficial holdings of the Company’s securities; the fact that, depending on the ultimate resolution of certain litigation as to the terms of the Cotter Trust, Mr. Cotter, Jr. could periodically or ultimately hold voting control over our Company, and the fact that Ellen M. Cotter and Margaret Cotter had notified the Board that, as the beneficial owners of over 70% of the voting power of our Company, they supported Mr. Cotter Jr.’s ongoing participation on the Board. After considering these factors, the Board nominated Mr. Cotter, Jr. to serve another term as a Director of the Company.

Each of the nominees named in Proposal 1 received at least seven (7)six (6) Yes votes, with each such nominee abstaining as to his or her nomination. Director Cotter, Jr. abstained with respect

After selecting the nominees named in Proposal 1, our Board then reduced the size of our Board to the nominationseven (7) members effective as of eachcompletion of the nominees other than Ellen M. Cotter and Margaret Cotter, and voted Yes for Ellen M. Cotter and Margaret Cotter. Director Adams voted No with respect tovote on the nominationelection of James Cotter, Jr.our Board at our upcoming Annual Meeting.

Code of Ethics

We have adopted a Code of Business Conduct and Ethics (the “Code of Conduct”) designed to help our Directors and employees resolve ethical issues. Our Code of EthicsConduct applies to all Directors and employees, including the Chief Executive Officer, the Chief Financial Officer, principal accounting officer, controller and persons performing similar functions. Our Code of EthicsConduct is posted on our website at http://www.readingrdi.com/Governance-Documentsabout/#policies-and-guidelines.

TheOur Board has established a means for employees to report a violation or suspected violation of the Code of EthicsConduct anonymously. In addition, we have adopted a “Whistlebloweran “Amended and Restated Whistleblower Policy and Procedures,” which is posted on our website, at http://www.readingrdi.com/Governance-Documentsabout/#policies-and-guidelines, that establishes a process by which employees may anonymously disclose to our Principal Compliance Officer (currently the Chair of our Audit CommitteeCommittee) alleged fraud or violations of accounting, internal accounting controls or auditing matters.

Review, Approval or Ratification of Transactions with Related Persons

TheOur Audit Committee adopted a written charterCharter delegates to that committee responsibility for review and approval of transactions between the Company and its Directors, Director nominees, executive officers, greater than five percent beneficial owners and their respective immediate family members, where the amount involved in the transaction exceeds or is expected to exceed $120,000 in a single calendar year and the party to the transaction has or will have a direct or indirect interest. A copy of this charter is available at www.readingrdi.com under the “Investor Relations” caption.http://www.readingrdi.com/about/#committee-charters. For additional information, see the section entitled ““Certain Relationships and Related Party Transactions.Transactions.”

Material

Certain Legal Proceedings Involving Claims Against our Directors

On

As previously disclosed in our public filings, James J. Cotter, Jr., has since June 12, 2015, the Board terminated James Cotter, Jr. as the Presidentbeen asserting various purported derivative claims against our directors and Chief Executive Officer of our Company. That same day, Mr. Cotter, Jr. filedCompany, pursuant to a lawsuit styled as both an individual and a derivative action, and titled “James“James J. Cotter, Jr., individually and derivatively on behalf of Reading International, Inc. vs. Margaret Cotter, et al.” Case No,: A-15-719860-V, Dept. XI, (the “Cotter Jr. Derivative Action” and the “Cotter, Jr. Complaint,” respectively) against the Company and each of our other then sitting Directors (Ellen M. Cotter, Margaret Cotter, Guy Adams, William Gould, Edward Kane, Douglas McEachern, and Tim Storey, the “Original Defendant Directors”) in the Eighth Judicial District Court of the State of Nevada for Clark County (the “Nevada District Court”). On October 22, 2015,Mr. Cotter, Jr.’s lawsuit, as amended from time to time, is referred to herein as the “Cotter Jr. Derivative Action” and his complaint, as amended from time to time, is referred to herein as the “Cotter Jr. Derivative Complaint.” The defendant directors named in the Cotter Jr. Derivative Complaint, from time to time, are referred to herein as the “Defendant Directors.”

All claims brought by Mr. Cotter, Jr., amended his complaint to drop his individual claims (the “Amendedagainst Defendant Directors Judy Codding, William Gould, Edward L. Kane, Douglas McEachern and Michael Wrotniak in the Cotter Jr. Derivative Complaint”). Accordingly,Action were dismissed with prejudice by the AmendedNevada District Court's order dated December 28, 2017, memorializing the Nevada District Court’s finding that Mr. Cotter, Jr., had failed to raise any genuine issue of material fact relating to the lack of independence or disinterestedness of these directors. Thereafter, on June 19, 2018, the Nevada District Court dismissed with prejudice all claims asserted by Mr. Cotter, Jr., against the remaining Defendant Directors, Guy Adams, Ellen Cotter and Margaret Cotter. The District Court granted the summary judgment motions in favor of these remaining Defendant Directors from the bench on June 19, 2018, and the Court’s final judgment was issued on August 8, 2018. Mr. Cotter, Jr., has appealed the Court’s December 28, 2017 order and it is anticipated that he will appeal the Court’s August 8, 2018 order as well.